Consider the following two lotteries:

Lottery A: $1 million 11% of the time and $0 89% of the time.

Lottery B: $5 million 10% of the time and $0 90% of the time.

Think for a moment about which you prefer. Write your answer down.

Now consider these two other lotteries:

Lottery C: $1 million guaranteed

Lottery D: $5 million 10% of the time, $1 million 89% of the time, and $0 1% of the time.

Of these two lotteries, which do you prefer?

There are no right or wrong answers for your individual choice between A and B and your individual choice between C and D. Your preference for risk may compel you to take safer options, or it may not. However, certain pairs of answers are inconsistent with expected utility theory.

First, recall the independence over lotteries axiom. Let p be a probability, and X, Y, and Z be outcomes or lotteries over outcomes. Independence says that if an individual prefers X to Y, he must also prefer the lottery of X with probability p and Z with probability 1 – p to the lottery of Y with probability p and Z with probability 1 – p. This is a sensible requirement for preferences. After all, Z with probability 1 – p is identical in both the lotteries. It therefore should not determine your preference between the two.

As economist Maurice Allais discovered, however, people have a hard time maintaining this consistency when X, Y, and Z are themselves lotteries. With that in mind, let’s redo the lotteries from above. Consider the following two lotteries:

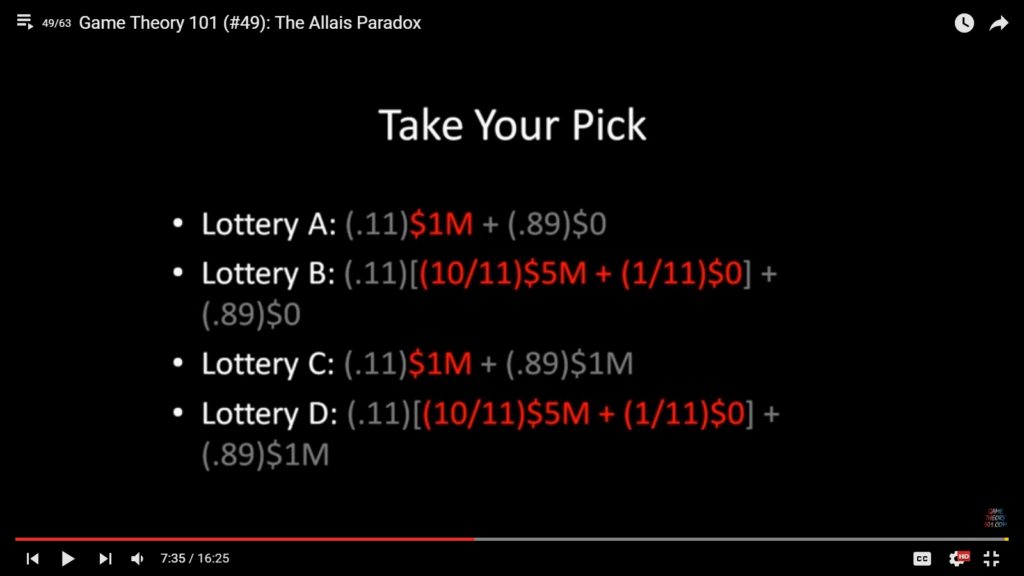

Lottery A’: $1 million 11% of the time and $0 89% of the time.

Lottery B’: 11% of the time, you receive a lottery that pays $5 million with probability 10/11 and $0 with probability 1/11. The remaining 89% of the time, you receive $0.

Think about which you prefer, and write it down.

Now let’s redo the second set of lottery:

Lottery C’: $1 million 11% of the time and $1 million 89% of the time.

Lottery D’: 11% of the time, you receive a lottery that pays $5 million with probability 10/11 and $0 with probability 1/11. The remaining 89% of the time, you receive $1 million.

Write your preference down.

Have your answers changed from the first time around? In some ways, they should be the same. Indeed, all of the lotteries are identical to the old ones. In some cases, I have rewritten the lottery to clarify how some lotteries are nested within others. But at the end of the day, each lottery pays out the same amounts with the same probabilities as their respective predecessor. Yet clarifying the compound nature of the lotteries can result individuals better understanding what they are buying, causing them to change their stated preferences accordingly.

So what preferences are consistent with independence? (1) A and C and (2) B and D are. (3) A and D or (4) B and C are not.

Further breaking down the lotteries might help explain why the AD and BC pairs do not make much sense. Notice that Lottery A and Lottery B both pay nothing 89% of the time. Consequently, that portion of those lotteries cannot determine one’s preference between them. The only thing that can is what remains: $1 million for Lottery A versus $5 million with probability 10/11 and $0 with probability 1/11. Whichever you prefer is completely up to you, but it is your preference between those two that should drive your preference for Lottery A versus Lottery B.

Now compare Lotteries C and D. Both pay $1 million 89% of the time. Consequently, that portion of the lotteries cannot determine one’s preference between them. The only thing that can is what remains: $1 million for Lottery A versus $5 million with probability 10/11 and $0 with probability 1/11. But this is exactly what appeared in the breakdown of Lottery A versus Lottery B! So if you said that you preferred the $1 million, you also said that you preferred Lottery A and must therefore prefer Lottery C. Alternatively, if you said you prefer $5 million with probability 10/11 and $0 with probability 1/11, you also said that you preferred Lottery B and must therefore prefer Lottery D.

If these breakdowns are confusing, the video above contains a helpful explanation between 2:33 and 7:36. This screencap might be useful as well:

Do people identify these similarities in practice? Yes and no. When I posted an older video on YouTube many years ago, I solicited everyone’s answers in the comments section. 16 out of 136 chose A and C, while 82 picked B and D. That is about 72% of those responding coming up with answers consistent with independence. Only 16 chose A and D, with the remaining 22 picking B and C. That is pretty good, though there may be a selection effect: those with inconsistent answers simply don’t submit their comments.

In more scientific settings, Maurice Allais found similar inconsistencies. Does that mean that game theoretical modeling is in trouble? Yes and no. The Allais paradox conclusively shows that when people are pressed for answers in quick time spans, they often give inconsistent answers. But that does not necessarily mean they have inconsistent preferences. When you took this informal survey, you perhaps spent a minute or two at most thinking about your answer. If you were actually facing such a choice, I suspect that you would spend a lot more time reasoning your way through the problem. You may even consult a friend, who could point out the inconsistency.

The takeaway here is that snap judgments can result in some inconsistent choices. This may weaken our ability to use models to predict rather mundane behaviors. However, this problem is far less concerning for bigger issues that individuals have more incentive to think over thoroughly. So we got that going for us, which is nice.